DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on September 8, 2006

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE |

| COMMISSION ONLY (AS PERMITTED BY |

| RULE 14A-6(E)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

CENTRAL GARDEN & PET COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party |

| (4) | Date Filed: |

Notes:

September 2006

2006 Special Meeting of Shareholders |

1 Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements contained in this release which are not historical facts, including future earnings guidance, are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. These risks are described in the Companys Securities and Exchange Commission filings. Central undertakes no obligation to publicly update these forward-looking statements to reflect new information, subsequent events or otherwise. Safe Harbor |

2 Why We Are Here Significantly increase Earnings per Share

Scale change in Company Size

More Stable Business base Stronger Competitive Leadership Position

PE Multiple Expansion potential Big Opportunities to Dramatically Increase Shareholder Value Big Opportunities |

3 Issue Current Board of Directors and Management team have created the company you have invested in Big opportunities require equity and new players (sellers) could gain control Big Opportunities How to Pursue Big Opportunities while Mitigating Risk to Existing Shareholders |

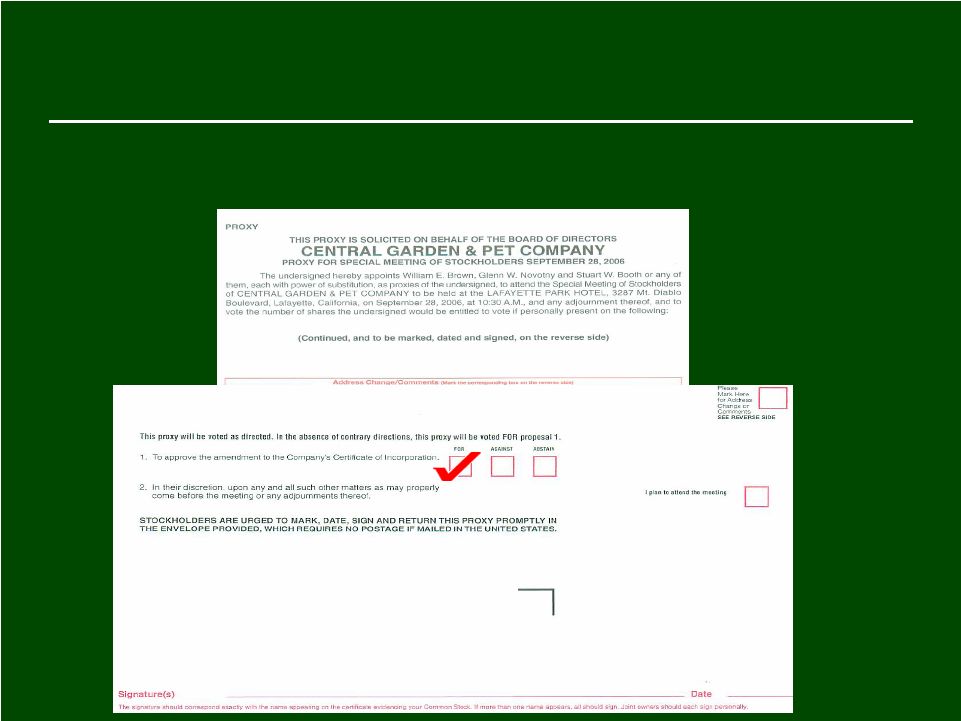

4 Solution New Class A Common Stock: Same as current Common Stock, less voting rights Proposal Rationale Authorize 100,000,000 shares of a new class of common stock, par value $0.01 per share, to be designated as Class A Common Stock that would generally have no voting rights Fix and establish the relative rights, powers and limitations of the Companys proposed Class A Common Stock Flexibility

To provide Management / Board of Directors with maximum flexibility to pursue a broader range of strategic growth opportunities Alignment

To continue to ensure the long-term interests of Shareholders and Management / Board of Directors are aligned for future growth Empowerment To continue to empower existing Shareholders relating to company performance and strategic direction Big Opportunities |

5 Through a combination of Organic Growth and Strategic Acquisitions, Central Garden & Pet successfully transitioned to a leading Branded Products company

with a Strong Portfolio of #1 Brands Pet Products Lawn & Garden Products Corporate Strategy Central Life Central Life Sciences Sciences Central Central Aquatics Aquatics Specialty Pet Specialty Pet Dog & Cat Dog & Cat Grass Seed Grass Seed Wild Bird Wild Bird Feed Feed Control Control Products Products Garden Garden Decor Decor Accomplishments to Date |

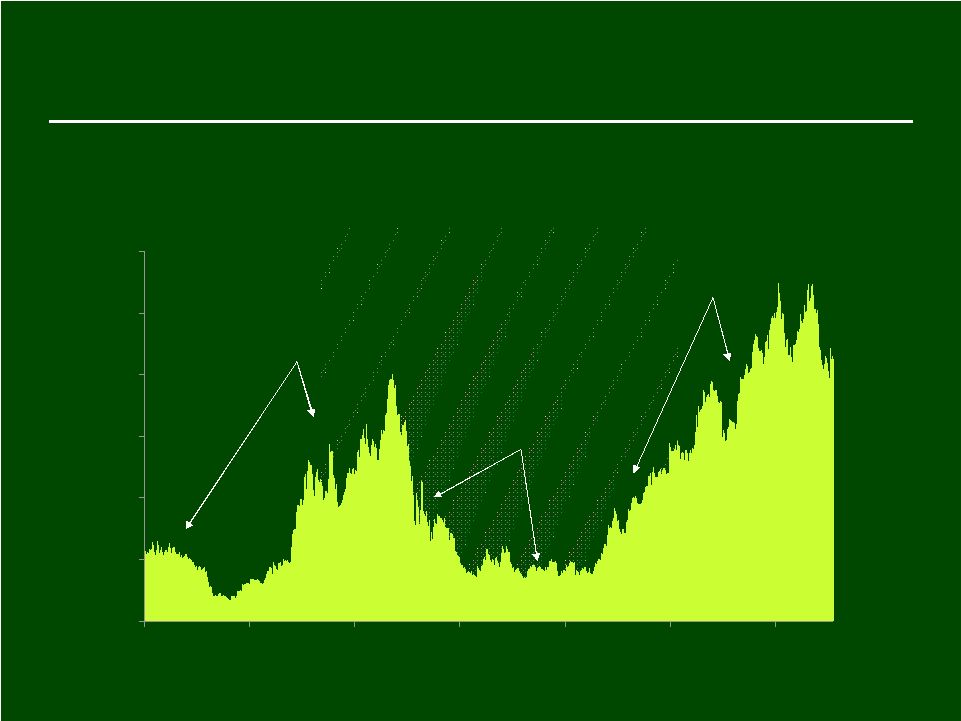

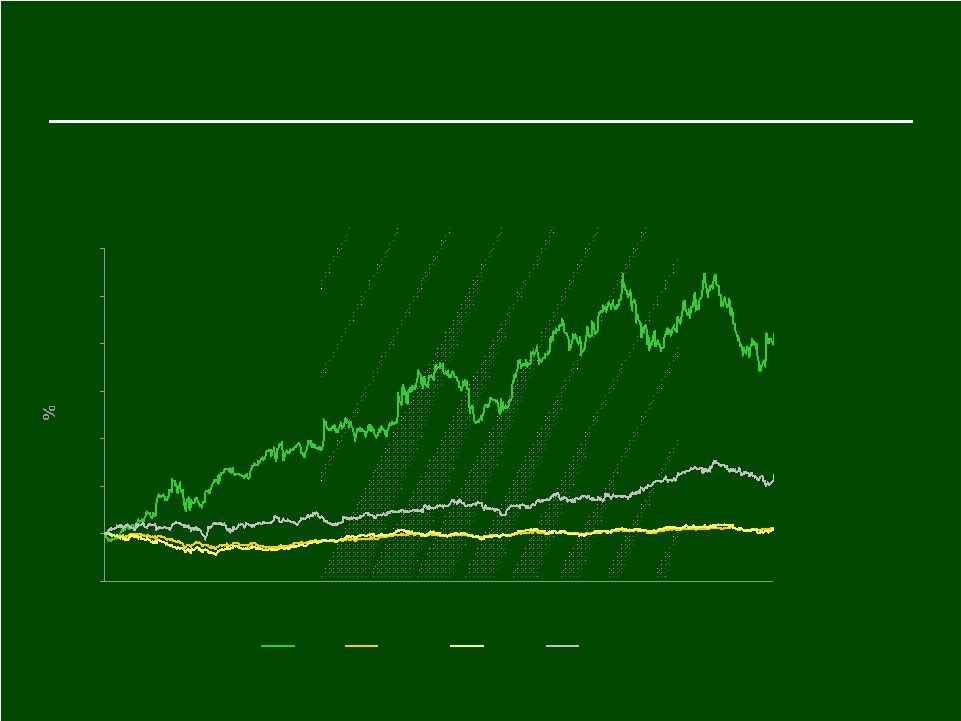

6 Corporate Strategy Stock Price Performance and Key Events since Initial Public Offering $0 $10 $20 $30 $40 $50 $60 07/15/93 07/15/95 07/15/97 07/15/99 07/15/01 07/15/03 07/15/05 Timeline of Significant Events CENT consolidates Lawn & Garden and Pet distribution industries creating the only national platform in both categories Management implements Branded Products strategy to mitigate distribution risk Monsanto divests Solaris lawn & garden business to Scotts. Management restructures business around highly successful branded products business Transformed into a #1 brands product business, CENT solidifies operations and financial position; accelerates String of Pearls acquisition strategy |

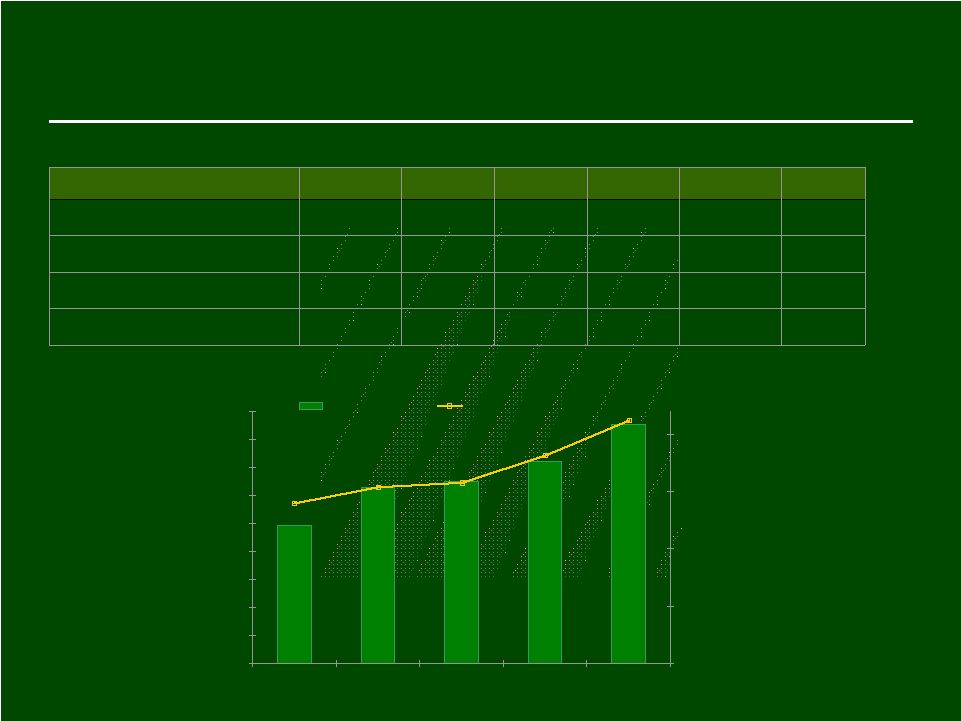

7 Corporate Strategy $1.73 35 72 1,145 2003 $1.24 29 53 1,078 2002 23% $2.85 $2.50 $1.99 EPS 23% 67 54 41 Net Income 26% 135 100 82 Operating Income 10% 1,580 1,381 1,267 Sales CAGR 2006 F** 2005 2004 Shift to Branded Products focus has produced Strong Financial Results ** Assumes midpoint of company-issued guidance of $2.80-$2.90 per share. Financial Performance 8.5% 7.2% 4.9% 6.5% 6.3% 81.2% 78.2% 75.8% 75.3% 74.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 2002 2003 2004 2005 2006 F 60.0% 65.0% 70.0% 75.0% 80.0% Operating Income % % Sales from Brands |

8 0 100 200 300 400 500 600 700 12/31/2001 12/31/2002 12/31/2003 12/31/2004 12/31/2005 CENT S&P 500 Nasdaq SMG Emphasis on Branded Products has produced Superior Returns for Shareholders Corporate Strategy Stock Performance 520% - CENT 114% 111% Current 224% |

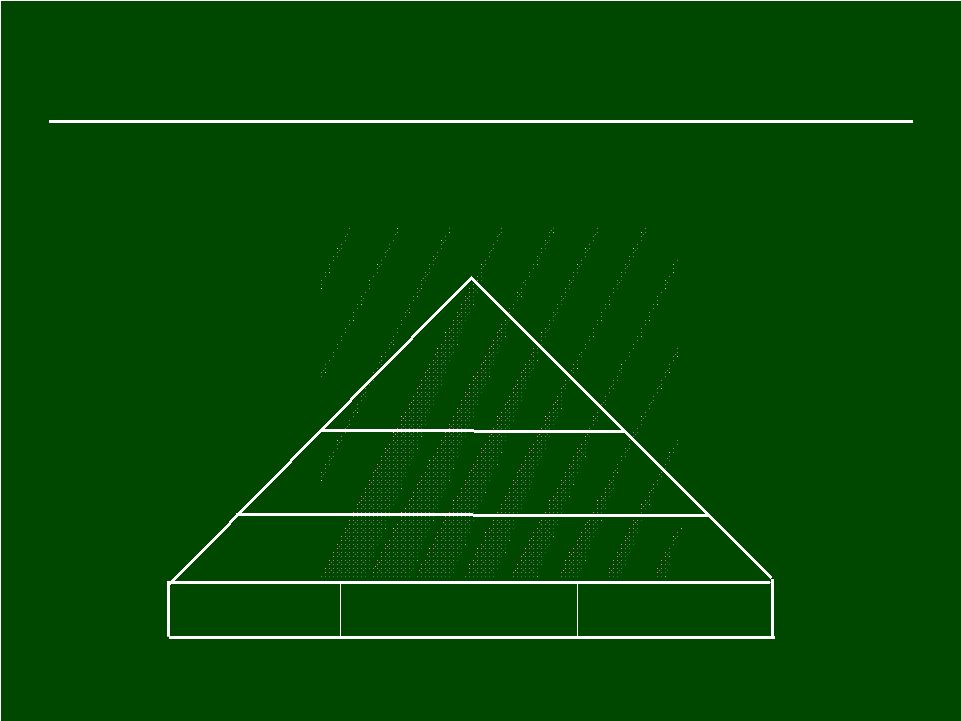

9 CENTRAL PERFORMANCE Quality Organic Growth Strategic Acquisitions Sales Margins Innovation Service Extend Brands Categories Awareness Expand Channels Markets Enhance Operating Leverage Corporate Strategy Framework for Growth |

10 Potential to be # 1 or # 2 Brand in its Category Organic Growth History and Potential Strong Management and Cultural Fit History of Innovation Profitable Business Ability to Complete Acquisitions at Reasonable Price 5 to 7 x LTM EBIT Target Accretive Day One Ability to Extend or Leverage the Brands into other Lines, Categories or Channels Growth Through Acquisition Acquisition Criteria Acquisitions are a Core Competency of Management - A rigorous, disciplined approach to each target - Leverage knowledge from distribution business |

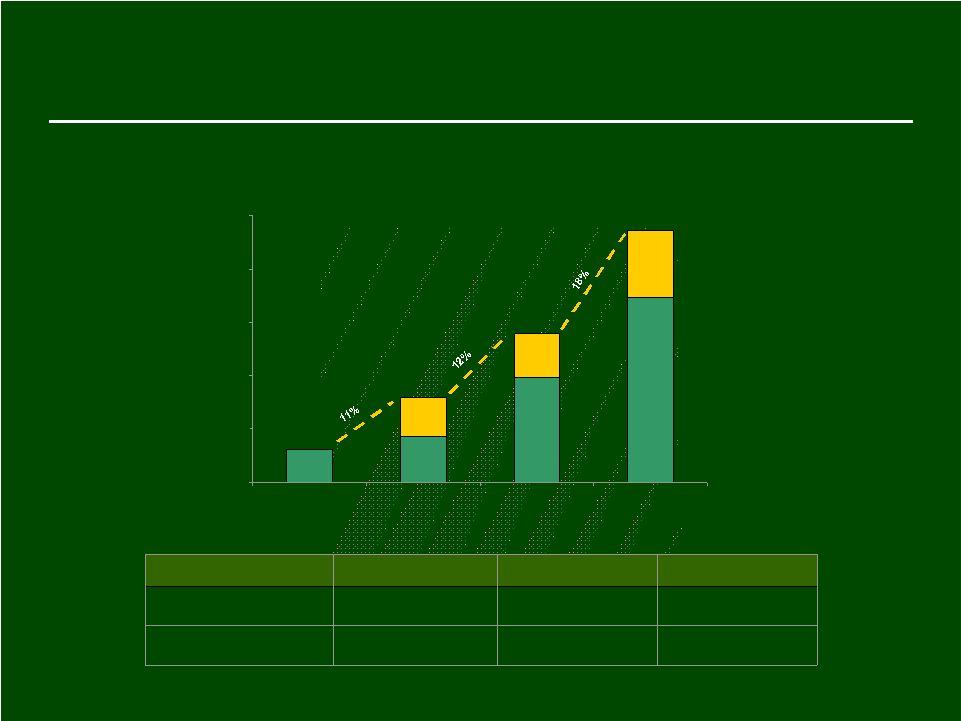

11 $800 $900 $1,000 $1,100 $1,200 $1,300 2003 2004 2005 2006 F Organic + Acquisitions Growth Through Acquisition $863 $960 $1,079 $1,273* * Represents an estimate of branded products sales based on the midpoint of company-issued sales guidance 74 83 126 18% 12% 11% Total Branded Products 3% 2004 12% 2005 15% 2006 F Branded Products Organic Sales Growth Contribution from Acquisitions Branded Products Organic Sales Growth Branded Products Sales Performance Driven by a Combination of Organic Growth and Contribution from Acquisitions |

12 Organic Sales 5% Operating Income 10% Acquisition Sales 10% Operating Income 15% Management consistently strives to Achieve / Surpass Objective Corporate Strategy Long-Term Growth Objective |

13 Paths to Future Growth String of Pearls: Current proven acquisition model Typically $10-70 MM in Sales CENT is often a Top 5 customer due to distribution relationship Sellers are often entrepreneur founders Complementary product offering Ability to complete transaction at 5-7x trailing EBIT Many targets Acquisition Considerations Future Growth Trophy Opportunities: Typically $200 MM+ sales CENT is frequently a distribution partner Trophies = carve out opportunities and/or private equity portfolio companies Strategic expansion into adjacent and/or new channels, markets, and categories Transaction prices 7+x trailing EBIT due to strategic nature and scale of potential target Fewer targets |

14 Summary Management has a Strong Track Record Successfully transitioned Central Garden & Pet into a Leading

Branded Products company Built portfolio of #1 Brands

in two highly desirable categories Innovation is core competency and competitive advantage Effectively completed and integrated over 40 Acquisitions

Numerous Organic Growth and Growth through Acquisition

opportunities remain Management has created Significant Value for Shareholders

|

15 Conclusion Vote For Empower the Board and Management to Pursue Big Opportunities where Rewards are High and Risks are Low |