DEF 14A: Definitive proxy statements

Published on December 29, 2005

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE |

| COMMISSION ONLY (AS PERMITTED BY |

| RULE 14A-6(E)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

CENTRAL GARDEN & PET COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party |

| (4) | Date Filed: |

Notes:

CENTRAL GARDEN & PET COMPANY

1340 Treat Blvd., Suite 600

Walnut Creek, California 94597

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Monday, February 13, 2006, 10:30 A.M.

TO THE STOCKHOLDERS:

Notice is hereby given that the Annual Meeting of Stockholders of Central Garden & Pet Company will be held at the LAFAYETTE PARK HOTEL, 3287 Mt. Diablo Boulevard, Lafayette, California, on Monday, February 13, 2006, at 10:30 A.M. for the following purposes:

| (1) | To elect seven directors; |

| (2) | To approve the amendment of the Nonemployee Director Equity Incentive Plan to revise the annual grants thereunder to nonemployee directors to be a number of options equal to $140,000 divided by the fair market value of the Companys Common Stock on the date of each annual meeting of stockholders and a number of shares of restricted stock equal to $15,000 divided by such fair market value; and |

| (3) | To transact such other business as may properly come before the meeting. |

Only stockholders of record on the books of the Company as of 5:00 P.M., December 19, 2005, will be entitled to vote at the meeting and any adjournment thereof. A complete list of the Companys stockholders entitled to vote at the meeting will be available for examination by any stockholder for ten days prior to the meeting during normal business hours at the Companys principal executive offices at 1340 Treat Blvd., Suite 600, Walnut Creek, California.

| Dated: December 29, 2005 |

By Order of the Board of Directors |

|||

| Stuart W. Booth, Secretary | ||||

STOCKHOLDERS ARE REQUESTED TO MARK, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE.

CENTRAL GARDEN & PET COMPANY

1340 Treat Blvd., Suite 600

Walnut Creek, California 94597

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of Central Garden & Pet Company (the Company) to be used at the Annual Meeting of Stockholders on February 13, 2006 (the Annual Meeting), for the purposes set forth in the foregoing notice. This proxy statement and the enclosed form of proxy were first sent to stockholders on or about January 6, 2006.

If the enclosed form of proxy is properly signed and returned, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If the proxy does not specify how the shares represented thereby are to be voted, the proxy will be voted as recommended by the Board of Directors. Any stockholder signing a proxy in the form accompanying this proxy statement has the power to revoke it prior to or at the Annual Meeting. A proxy may be revoked by a writing delivered to the Secretary of the Company stating that the proxy is revoked, by a subsequent proxy signed by the person who signed the earlier proxy, or by attendance at the Annual Meeting and voting in person.

VOTING SECURITIES

Only stockholders of record on the books of the Company as of 5:00 P.M., December 19, 2005, will be entitled to vote at the Annual Meeting.

As of the close of business on December 19, 2005, there were outstanding 19,558,919 shares of Common Stock of the Company, entitled to one vote per share, and 1,654,462 shares of Class B Stock of the Company, entitled to the lesser of ten votes per share or 49% of the total votes cast. Holders of Common Stock and Class B Stock will vote together on all matters presented to the stockholders for their vote or approval at the meeting, including the election of directors and the amendment of the Nonemployee Director Equity Incentive Plan.

The holders of a majority of the outstanding shares of the stock of the Company, present in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting or any adjournment thereof. Votes cast by proxy or in person at the Annual Meeting will be tabulated by the election inspector appointed for the meeting and will determine whether or not a quorum is present. The election inspector will treat abstentions and broker non-votes as shares that are present and entitled to vote for purposes of determining the presence of a quorum but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote.

With regard to the election of directors, votes may be cast For or Withhold Authority for each nominee; votes that are withheld will be excluded entirely from the vote and will have no effect. The directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. As a result, if you withhold your authority to vote for any nominee, your vote will not count for or against the nominee, nor will a broker non-vote affect the outcome of the election.

The proposal to amend the Companys Nonemployee Director Equity Incentive Plan requires the affirmative vote of a majority of shares represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon. Accordingly, abstentions on the proposal to amend the Nonemployee Director Equity Incentive Plan will have the effect of a negative vote on this item. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter. Therefore, a broker non-vote will have no effect on the proposal to amend the Nonemployee Director Equity Incentive Plan.

1

ELECTION OF DIRECTORS

The persons named below are nominees for director to serve until the next annual meeting of stockholders and until their successors shall have been elected. The nominees are all members of the present Board of Directors. In the absence of instructions to the contrary, shares represented by the proxy will be voted and the proxies will vote for the election of all such nominees to the Board of Directors. If any of such persons is unable or unwilling to be a candidate for the office of director at the date of the Annual Meeting, or any adjournment thereof, the proxies will vote for such substitute nominee as shall be designated by the proxies. Management has no reason to believe that any of such nominees will be unable or unwilling to serve if elected a director. Set forth below is certain information concerning the nominees which is based on data furnished by them.

| Nominees for Director |

Age |

Business Experience During Past Five Years and Other Information |

Served as Director Since |

|||

| William E. Brown |

64 | Chairman of the Board since 1980. From 1980 to June 2003, Mr. Brown also served as Chief Executive Officer of the Company. | 1980 | |||

| Glenn W. Novotny |

58 | Chief Executive Officer since June 2003 and President since 1990. Prior to 1990, Mr. Novotny was with Weyerhaeuser Corporation in a variety of capacities. | 1990 | |||

| Brooks M. Pennington III |

51 | Chief Executive Officer of Pennington Seed, Inc., a business which was acquired by the Company in 1998, since 1994. Mr. Pennington is not a corporate officer of the Company, but because he is the chief executive officer of a principal subsidiary of the Company, he is deemed to be an executive officer by virtue of the Securities and Exchange Commission rules. | 1998 | |||

| John B. Balousek |

60 | Mr. Balousek served as President and Chief Operating Officer of Foote, Cone & Belding Communications, one of the largest global advertising and communications networks, from 1991 until 1996 and as Chairman and CEO of True North Technologies, a digital and interactive services company affiliated with True North Communications in 1996. Mr. Balousek co-founded and, from 1998 to 1999, served as an Executive Vice President of PhotoAlley.com, a San Francisco company marketing photographic equipment, supplies and services online. Prior to 1991, he held various senior executive management positions with Foote, Cone & Belding Communications and positions in brand management with the Procter & Gamble Company. He also currently serves as a director at Interland, Inc., an internet hosting and business services company, and Aptimus, Inc., a performance-based lead generation network. | 2001 | |||

| David N. Chichester |

60 | Partner of Tatum CFO Partners, LLP, a professional services firm, since 2004. Mr. Chichester was the Chief Financial Officer of Starbucks Coffee Japan, Ltd. from 2003 to 2004 and the Senior Vice President Finance of Starbucks Coffee Company from 2001 to 2003. Mr. Chichester served as Executive Vice President and Chief Financial Officer at Hecklers Online, Inc. during 2000 and | 2002 | |||

2

| Nominees for Director |

Age |

Business Experience During Past Five Years and Other Information |

Served as Director Since |

|||

| at Red Roof Inns, Inc. from 1996 to 1999. Prior to these positions, he held senior management positions in finance at Integrated Health Services, Inc., Marriott Corporation and General Electric Credit Corporation, and served as Vice President-Investment Banking of Warburg Paribas Becker Incorporated. | ||||||

| Alfred A. Piergallini |

59 | Consultant with Desert Trail Consulting, a marketing consulting organization, since January 2001 and Chairman of Wisconsin Cheese Group, Inc., a specialty cheese company, since January 2005. From December 1999 to December 2001, Mr. Piergallini served as the Chairman, President and Chief Executive Officer of Novartis Consumer Health Worldwide, a manufacturer, developer and marketer of health-related products, and from February 1999 to December 1999, Mr. Piergallini served as the President and Chief Executive Officer of Novartis Consumer Health North America. From 1989 to 1999, Mr. Piergallini held several senior management positions with Gerber Products Company, including, at various times, the offices of Chairman of the Board, President and Chief Executive Officer. He also currently serves as a director of Comerica Incorporated, a financial services company. | 2004 | |||

| Bruce A. Westphal |

65 | Chairman of Bay Alarm Company, a security systems company, since 1984. Mr. Westphal is also Chairman of InReach Internet, a provider of internet services, and President of Balco Properties, a real estate development and management company. Mr. Westphal was also Chairman of PacWest Telecomm, Inc. from 1994 to 1998. | 1999 | |||

The Board of Directors unanimously recommends that stockholders vote FOR each of the director nominees listed above.

FURTHER INFORMATION CONCERNING

THE BOARD OF DIRECTORS

Board Independence

Upon consideration of the criteria and requirements regarding director independence set forth in NASD Rules 4200 and 4350, the Board of Directors has determined that each of Mr. Balousek, Mr. Chichester, Mr. Piergallini and Mr. Westphal meet the standards of independence established by the NASD.

Committees of the Board

During fiscal 2005, the Board of Directors held 8 meetings and acted by unanimous written consent on a number of occasions. The Company has an Audit Committee and a Compensation Committee but does not have a nominating committee or a committee performing the functions of a nominating committee.

The members of the Audit Committee are Bruce A. Westphal (Chairman), John B. Balousek and David N. Chichester. The Companys Board of Directors has determined that David N. Chichester qualifies as an audit committee financial expert as set forth in Section 401(h) of Regulation S-K promulgated by the Securities and

3

Exchange Commission (the SEC) and he is independent as such term is defined in the NASD Rules. Among the functions performed by the Audit Committee are to make recommendations to the Board of Directors with respect to the engagement or discharge of the Companys independent registered public accounting firm, to review with the independent registered public accounting firm the plan and results of the auditing engagement, to review the Companys system of internal financial and accounting controls, to review the financial statements of the Company, to discuss the Companys accounting policies, and to make inquiries into matters within the scope of its functions. The Board of Directors has adopted a written Audit Committee Charter, a copy of which is attached as Appendix A to this proxy statement. The Audit Committee held 16 meetings during fiscal 2005.

The members of the Compensation Committee are John B. Balousek (Chairman), Bruce A. Westphal and Alfred A. Piergallini. Among the functions performed by the Compensation Committee are to review and make recommendations to the Board of Directors concerning the compensation of the key management employees of the Company and to administer the Companys equity incentive plan. The Compensation Committee held five meetings during fiscal 2005.

Attendance at Meetings

During fiscal 2005, there were no members of the Board of Directors who attended fewer than seventy-five percent of the meetings of the Board of Directors and all committees of the Board on which they served.

Compensation of Directors

In fiscal 2005, members of the Board of Directors who were not employees of the Company were paid directors fees consisting of $20,000 per year and $1,000 for each Board meeting attended. The committee chairs for the Audit Committee and the Compensation Committee each received an additional retainer of $10,000 for their service during fiscal 2005. Directors who attended meetings of the Audit Committee or Compensation Committee received an additional $1,000 for each meeting not held on the same day as a Board meeting.

In fiscal 2006, members of the Board of Directors who are not employees of the Company will be paid directors fees consisting of $25,000 per year and $1,200 for each Board meeting attended. The chairs of the Audit Committee and the Compensation Committee will receive annual retainer fees of $12,000 and directors who attend meetings of the Audit Committee or Compensation Committee will receive an additional $1,200 for each meeting not held on the same day as a Board meeting.

Each director receives $500 for participation in each telephonic meeting of the Board of Directors, the Audit Committee or the Compensation Committee of less than three hours and $1,000 for participation in meetings of three hours or more. The Company pays non-employee directors $1,000 for each day spent attending subsidiary and division management meetings and conducting plant and facility visits.

Under the Nonemployee Director Equity Incentive Plan, Messrs. Balousek, Chichester, Westphal and Piergallini were each granted on the date of the 2005 Annual Meeting of Stockholders options to purchase 2,295 shares of Common Stock (determined by dividing $100,000 by the fair market value of a share of Common Stock on the date of the 2005 Annual Meeting) and a restricted stock grant for 230 shares with a market value of $10,000. If the proposed amendment to the Nonemployee Director Equity Incentive Plan is approved, the nonemployee directors will receive, on the date of the Annual Meeting, options to purchase the number of shares of Common Stock determined by dividing $140,000 by the fair market value of a share of Common Stock on the date of the Annual Meeting and a number of shares of restricted stock equal to $15,000 divided by such fair market value.

Director Nominations

Due to the limited size of the Board, the Board has determined that it is not appropriate at this time to establish a separate nominating committee. As such, the Board as a whole fulfills the function of nominating

4

additional directors. A majority of the members of the Board have been determined by the Board to be independent under the standards established by the NASD. At a minimum, the Chairman of the Board, as well as at least two independent directors, must interview any qualified candidates prior to nomination. Other directors and members of management will also interview each candidate as requested by the Chairman. Once potential candidates have successfully progressed through the interview stage, the independent directors will meet in executive session to consider the screened candidates. All director nominees must be selected, or recommended for the Boards selection, by a majority of the independent directors.

A majority of the members of the Board must be independent directors as defined in NASD Rule 4200(a)(15). When considering potential director candidates, the Board also considers the candidates knowledge, experience, integrity, leadership, reputation and ability to understand the Companys business. In addition, all director nominees must possess certain core competencies, some of which may include experience in consumer products, logistics, product design, merchandising, marketing, general operations, strategy, human resources, technology, media or public relations, finance or accounting, or experience as a Chief Executive Officer or Chief Financial Officer.

The Board will consider any director candidate recommended by security holders, provided that the candidate satisfies the minimum qualifications for directors as established from time to time by the Board. To be considered, stockholders must submit recommendations to the Companys secretary for consideration by the Board no later than 120 days before the annual meeting of stockholders. To date, the Board has not received any recommended nominees for consideration at the Annual Meeting from any non-management stockholder or group of stockholders that beneficially owns five percent or more of the Companys voting stock.

When the need arises, the Company has engaged and intends to continue to engage independent search firms and consultants to identify potential director nominees and assist the Board in identifying a diverse pool of qualified candidates and in evaluating and pursuing individual candidates at the direction of the Chairman of the Board.

All of the nominees included on this years proxy card are directors standing for re-election.

Stockholder Communications with Directors

The Board welcomes communications from the Companys stockholders. Stockholders may send communications to the Board, or to any director in particular, c/o Central Garden & Pet Company, 1340 Treat Blvd., Suite 600, Walnut Creek, California 94597. Any correspondence addressed to the Board or to any director care of the Companys offices is forwarded by the Company to the addressee without review by management.

The Company encourages, but does not require, the members of its Board of Directors to attend its annual meetings of stockholders. All members of the Board attended the 2005 Annual Meeting of Stockholders.

EXECUTIVE COMPENSATION

Compensation of Executive Officers

The compensation paid to the Companys Chief Executive Officer and the other executive officers who received compensation in excess of $100,000 for services in all capacities to the Company and its subsidiaries during fiscal 2003, 2004 and 2005 is set forth below.

5

SUMMARY COMPENSATION TABLE

|

Annual Compensation |

Long-Term Compensation Awards |

|||||||||||||||||||

| Name and Principal Position |

Fiscal Year |

Salary($) |

Bonus($) |

Other Annual Compensation ($)(1) |

Restricted Stock Awards($)(2) |

Securities Underlying Options(#) |

All Other Compensation($) |

|||||||||||||

| Glenn W. Novotny President and Chief Executive Officer(3) |

2005 2004 2003 |

$ $ $ |

659,410 629,192 495,866 |

$ $ |

(4) 410,000 360,000 |

|

|

|

|

24,000 25,000 25,000 |

$ $ $ |

3,500 2,375 2,375 |

(5) (5) (5) |

|||||||

| William E. Brown Chairman(6) |

2005 2004 2003 |

$ $ $ |

409,994 409,994 410,000 |

$ $ |

(4) 260,000 360,000 |

|

|

|

|

14,000 15,000 25,000 |

$ $ $ |

2,375 2,375 2,375 |

(5) (5) (5) |

|||||||

| Stuart W. Booth Executive Vice President And Chief Financial Officer(7) |

2005 2004 2003 |

$ $ $ |

347,258 335,789 316,250 |

$ $ |

(4) 160,000 150,000 |

|

$ |

383,600 |

(8) |

10,000 15,000 30,000 |

$ $ $ |

3,500 3,250 3,000 |

(5) (5) (5) |

|||||||

| Brooks M. Pennington III Chief Executive Officer of Pennington Seed, Inc. |

2005 2004 2003 |

$ $ $ |

352,932 336,134 330,485 |

$ $ |

(4) 65,978 95,000 |

|

|

|

|

9,000 13,000 15,000 |

$ $ $ |

7,374 7,252 7,543 |

(9) (10) (11) |

|||||||

| James V. Heim President of Pet Products Division(12) |

2005 2004 2003 |

$ $ |

375,000 23,077 N/A |

|

(4) N/A |

N/A |

$ |

471,300 N/A |

(13) |

20,000 N/A |

|

N/A |

|

|||||||

| (1) | While the named executive officers enjoyed certain perquisites for fiscal years 2003, 2004 and 2005, these did not exceed the lesser of $50,000 or 10% of each officers salary and bonus. |

| (2) | As of September 24, 2005, the named executive officers did not hold any shares of restricted stock other than those awarded in fiscal 2004 and fiscal 2005, as disclosed in this table. |

| (3) | Mr. Novotny became Chief Executive Officer on June 1, 2003. |

| (4) | Fiscal 2005 bonus amounts have not been determined as of the date of this proxy statement. |

| (5) | Represents the matching contribution which the Company made on behalf of the executive officer to the Companys 401(k) Plan. |

| (6) | Mr. Brown ceased serving as Chief Executive Officer on June 1, 2003. |

| (7) | Mr. Booth was appointed Executive Vice President in October 2005. |

| (8) | Mr. Booth was awarded 10,000 shares of restricted stock on December 9, 2004. The closing price of the registrants unrestricted Common Stock on such date was $38.36. The shares will vest, and the restrictions will lapse, as to 20% of the shares on December 9, 2007 and on the anniversary of that date in each of the four years following thereafter, conditioned upon Mr. Booths continued employment with the Company. The closing price of the Companys Common Stock as of the last trading day of fiscal 2005 was $44.08, which equates to a market value for the 10,000 shares (assuming such shares were unrestricted) of $440,800. The restricted stock award is entitled to dividends to the extent that any are paid by the Company. |

| (9) | Includes a $3,504 matching contribution which the Company made on behalf of the executive officer to Pennington Seeds 401(k) Plan and $3,870 paid under Pennington Seeds profit-sharing plan. |

| (10) | Includes a $3,519 matching contribution which the Company made on behalf of the executive officer to Pennington Seeds 401(k) Plan and $3,733 paid under Pennington Seeds profit-sharing plan. |

| (11) | Includes a $2,875 matching contribution which the Company made on behalf of the executive officer to Pennington Seeds 401(k) Plan and $4,668 paid under Pennington Seeds profit-sharing plan. |

| (12) | Mr. Heim was appointed President of the Companys Pet Products Division in August 2004. |

| (13) | Mr. Heim was awarded 15,000 shares of restricted stock on August 20, 2004. The closing price of the Companys unrestricted Common Stock on such date was $31.42. The shares will vest, and the restrictions will lapse, as to 25% of the shares on August 20, 2006 and on the anniversary of that date in each of the |

6

| three years following thereafter, conditioned upon Mr. Heims continued employment with the Company. The closing price of the Companys Common Stock as of the last trading day of fiscal 2005 was $44.08, which equates to a market value for the 15,000 shares (assuming such shares were unrestricted) of $661,200. The restricted stock award is entitled to dividends to the extent any are paid by the Company. |

The following table sets forth certain information regarding stock options granted during fiscal 2005 to the executive officers named in the Summary Compensation Table. None of such persons received awards of stock appreciation rights during fiscal 2005.

OPTION GRANTS IN LAST FISCAL YEAR

|

Individual Grants |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(3) |

|||||||||||||||

|

Number of Securities Underlying Options Granted(#)(1) |

Percent of Total Options Granted to Employees in Fiscal Year |

Exercise or Base Price ($/Sh)(2) |

Expiration Date |

|||||||||||||

| Name |

5%($) |

10%($) |

||||||||||||||

| Glenn W. Novotny |

24,000 | 4.9 | % | $ | 38.58 | 12/9/2013 | $ | 510,486 | $ | 1,257,351 | ||||||

| William E. Brown |

14,000 | 2.9 | % | $ | 38.58 | 12/9/2013 | $ | 297,783 | $ | 733,455 | ||||||

| Stuart W. Booth |

10,000 | 2.0 | % | $ | 38.58 | 12/9/2013 | $ | 212,702 | $ | 523,896 | ||||||

| Brooks M. Pennington III |

9,000 | 1.8 | % | $ | 38.58 | 12/9/2013 | $ | 191,432 | $ | 471,507 | ||||||

| James V. Heim |

| | | | | | ||||||||||

| (1) | The options granted to each of Messrs. Novotny, Brown, Booth and Pennington vest in increments of 20% upon each of the fourth, fifth, sixth, seventh and eighth anniversaries of the grant date. Under the terms of the Companys 2003 Omnibus Equity Incentive Plan, the Compensation Committee retains discretion, subject to plan limits, to modify the terms of outstanding options. |

| (2) | All options were granted at fair market value at date of grant. |

| (3) | Realizable values are reported net of the option exercise price. The dollar amounts under these columns are the result of calculations at the 5% and 10% rates (determined from the price at the date of grant, not the stocks current market value) set by the SEC and therefore are not intended to forecast possible future appreciation, if any, of the Companys stock price. Actual gains, if any, on stock option exercises are dependent on the future performance of the Common Stock as well as the optionholders continued employment through the vesting period. The potential realizable value calculation assumes that the optionholder waits until the end of the option term to exercise the option. |

7

The following table sets forth certain information with respect to stock options exercised during fiscal 2005 and stock options held by each of the executive officers named in the Summary Compensation Table as of September 24, 2005. The closing price of the Companys Common Stock on the last trading day of the fiscal year was $44.08 per share.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FY-END OPTION VALUE

|

Shares Acquired On Exercise(#) |

Value Realized($) |

Number of Securities Underlying Unexercised Options at FY-End(#) |

Value of Unexercised In-the-Money Options at FY-End($) |

||||||

| Name |

Exercisable/Unexercisable |

Exercisable/Unexercisable |

|||||||

| Glenn W. Novotny |

135,000 | $ | 4,522,631 | 25,000/149,000 | $ 558,500/$3,710,000 | ||||

| William E. Brown |

100,000 | $ | 3,554,500 | 25,000/ 29,000 | $ 558,500/$ 347,000 | ||||

| Stuart W. Booth |

22,000 | $ | 873,328 | 43,000/ 40,000 | $1,355,420/$ 660,100 | ||||

| Brooks M. Pennington III |

52,334 | $ | 1,663,155 | 7,500/ 82,000 | $ 167,550/$2,160,300 | ||||

| James V. Heim |

| | 0/ 20,000 | $ 0/$ 256,600 | |||||

Equity Compensation Plan Information

The following table gives information about the Companys Common Stock that may be issued upon the exercise of options, warrants and rights under all of its existing equity compensation plans as of September 24, 2005.

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) |

||||||

| (a) | (b) | (c) | |||||||

| Equity compensation plans approved by security holders |

1,639,701 | (1) | $ | 27.01 | 4,295,922 | (2) | |||

| Equity compensation plans not approved by security holders |

| | | ||||||

| Total |

1,639,701 | (1) | $ | 27.01 | 4,295,922 | (2) | |||

| (1) | Includes 1,317,635 shares issuable upon exercise of options granted under the 2003 Omnibus Equity Incentive Plan, 276,500 shares issuable upon exercise of options granted under the 1993 Omnibus Equity Incentive Plan and 45,566 shares issuable upon exercise of options granted under the Nonemployee Director Equity Incentive Plan. |

| (2) | Includes 4,189,566 shares available for issuance under the 2003 Omnibus Equity Incentive Plan and 106,356 shares available for issuance under the Nonemployee Director Equity Incentive Plan. |

Employment Arrangements

The Company and Glenn W. Novotny are party to a Nonqualified Deferred Compensation Agreement which has an effective date of June 19, 2002. Pursuant to this agreement, Mr. Novotny has had the right to defer receipt of a portion of his salary and bonus, at such times and in such amounts as approved by the Compensation Committee of the Board of Directors. Compensation deferred pursuant to this plan is credited with investment return or loss in accordance with the performance of a measuring investment fund or funds.

The Board of Directors of the Company approved, on December 14, 2005, the amendment and restatement of the Nonqualified Deferred Compensation Agreement discussed above (as so amended and restated, the

8

Deferred Compensation Plan). Pursuant to the Deferred Compensation Plan, eligible employees of the Company may elect to defer receipt of a percentage of their base salary and/or incentive bonuses until a future date or dates. Compensation deferred pursuant to this Plan will be credited with investment return or loss in accordance with the performance of a measuring investment fund or funds.

On May 6, 2003, Pennington Seed, Inc. and Brooks Pennington III entered into a Modification and Extension of the Employment Agreement dated as of February 27, 1998. The modified and extended agreement provides that Mr. Pennington will serve as President and Chief Executive Officer of Pennington Seed, Inc. at an annual minimum salary of $326,610. The agreement terminates in February 2006, unless terminated earlier for his dismissal with cause, death or disability.

On July 9, 2004, the Company entered into an Employment Agreement with James V. Heim. This employment agreement provides that Mr. Heim will serve as President of the Companys Pet Products division at an annual minimum salary of $375,000. He is also eligible for an annual bonus, targeted at 50% of base compensation with a maximum payout of 100%, subject to his and the Companys performance. The agreement terminates in August 2007, unless terminated earlier for his dismissal with cause, death or disability. If the Company terminates Mr. Heim without cause, he will continue to receive the compensation and benefits provided thereunder for the remaining term of the agreement.

On September 30, 2005, the Company entered into an Employment Agreement with Bradley P. Johnson. This employment agreement, which has a term of five years, provides that Mr. Johnson will serve as President of the Companys Garden Group at an annual salary of $450,000. He is also eligible for an annual bonus, targeted at 50% of base compensation with a maximum payout of 100%, subject to his and the Companys performance. For fiscal 2006, Mr. Johnsons bonus is guaranteed at the 50% level. Mr. Johnson is also entitled to a transition fee of $250,000 payable upon his start of employment and $250,000 payable upon the first anniversary of his employment. This transition fee is subject to repayment if Mr. Johnson does not remain employed by the Company for at least two years. The Company will also reimburse Mr. Johnson for certain relocation expenses and for a portion of the difference in the interest costs associated with a new home in the Walnut Creek, California area and his previous home. If the Company terminates Mr. Johnson other than for cause, he will continue to receive compensation and benefits for one year. If Mr. Johnson terminates his employment for Material Breach (as defined in the agreement), he will continue to receive compensation and benefits for one year. The agreement terminates in November 2010, unless terminated earlier for his dismissal with cause, death or disability.

The Company and Mr. Novotny entered into a Post Employment Consulting Agreement on November 7, 2005. This consulting agreement provides that, in the event Mr. Novotnys employment with the Company terminates, for a period of twenty-four (24) months thereafter Mr. Novotny will be available approximately 10 hours per month to provide strategic advice and counsel to the Company. Mr. Novotny will be paid a base fee of $5,000 per month during the term of such consulting relationship. The base consulting fee shall increase 2% each year following the signing of the agreement. This agreement contains confidentiality and non-competition provisions.

Compensation Committee Interlocks and Insider Participation

Messrs. Westphal, Balousek and Piergallini served as members of the Compensation Committee during fiscal 2005. They have no relationship with the Company other than as directors and stockholders. During fiscal 2005, no executive officer of the Company served as a director, or as a member of any compensation committee, of any other for-profit entity that had an executive officer that served on the Board of Directors or Compensation Committee of the Company.

9

Transactions with the Company

Brooks M. Pennington III is a minority shareholder and a director of Bio Plus, Inc., a company that produces granular peanut hulls. During the twelve months ended September 24, 2005, Bio Plus, Inc.s total revenues were approximately $3.4 million, of which approximately $1.7 million were derived from sales to subsidiaries of the Company. As of September 24, 2005, the Company owed Bio Plus, Inc. approximately $13,000 for such purchases.

A subsidiary of the Company leases warehouse facilities from Pennington Investments I, L.P., of which Brooks M. Pennington III is the Chief Operating Officer of the Managing General Partner. During the twelve months ended September 24, 2005, the Company paid approximately $46,000 in lease payments to Pennington Investments I, L.P.

10

PROPOSAL TO APPROVE AMENDMENT OF

THE NONEMPLOYEE DIRECTOR EQUITY INCENTIVE PLAN

In February 1996, the Board of Directors approved the adoption of the Nonemployee Director Stock Option Plan (the Director Plan), which was subsequently approved by the Companys stockholders at the annual meeting in March 1997. In June 2001, the Board of Directors of the Company approved an amendment to the Director Plan, which amendment was subsequently approved by the stockholders at the 2002 Annual Meeting, to increase the number of shares authorized for issuance under the Director Plan by an additional 100,000 shares and to revise the awards available under the Director Plan to provide each director who is not an employee annually with a nonstatutory stock option (an Option) to purchase a number of shares of the Companys Common Stock equal to $100,000 divided by the fair market value of the Companys Common Stock on the date of each annual meeting of stockholders and a grant of a number of shares of restricted stock (Restricted Stock) equal to $10,000 divided by the fair market value of the Companys Common Stock on the date of such annual meeting. The amendment also changed the name of the Director Plan to the Nonemployee Director Equity Incentive Plan.

On December 14, 2005, the Board of Directors of the Company amended the Director Plan, subject to stockholder approval at the Annual Meeting, to increase the awards available under the Director Plan so as to provide each Nonemployee Director (as defined below) annually with an Option to purchase a number of shares of the Companys Common Stock equal to $140,000 divided by the fair market value of the Companys Common Stock on the date of each annual meeting of stockholders and a grant of a number of shares of Restricted Stock equal to $15,000 divided by the fair market value of the Companys Common Stock on the date of such annual meeting.

The closing price of the Companys Common Stock on December 27, 2005 was $46.29.

Description of the Director Plan

The following summary of the principal features of the amended Director Plan is qualified in its entirety by the full text of the Director Plan.

Purpose

The purpose of the Director Plan is to promote the success, and enhance the value, of the Company by attracting, retaining and motivating members of the Board of Directors who possess outstanding competence and who are neither employees of the Company nor of any affiliate of the Company (Nonemployee Directors). The Director Plan also is designed to align the interests of Nonemployee Directors with the interests of the stockholders of the Company.

Eligibility to Participate in the Director Plan

All Nonemployee Directors automatically become participants in the Director Plan. At present, the Company has four Nonemployee Directors: John B. Balousek, Alfred A. Piergallini, David N. Chichester and Bruce A. Westphal.

Administration, Amendment and Termination

The Director Plan is administered by the Board of Directors. The Board of Directors has all discretion and authority necessary or appropriate to administer the Director Plan and to control its operation in accordance with its terms. The Board of Directors also may amend or terminate the Director Plan at any time and for any reason.

Number of Shares Available Under the Director Plan

A total of 200,000 shares of Common Stock are reserved for issuance under the Director Plan. In the event of any stock split, stock dividend or other change in the capital structure of the Company, the Board of Directors

11

may make such adjustment, if any, as it deems appropriate in the number and/or class of shares of Common Stock that are available for grant under the Director Plan and the number and class of and/or the exercise price of shares of Common Stock subject to outstanding Options. Shares issued under the Director Plan may be authorized but unissued shares of Common Stock or treasury shares. If an Option expires without having been fully exercised or Restricted Stock does not vest, the shares subject thereto again will be available for grant.

Restricted Stock

Under the amended Director Plan, each Nonemployee Director automatically will receive, on the date of the Annual Meeting and at each subsequent annual meeting on which he or she is a Nonemployee Director, a Restricted Stock grant for such number of shares of Common Stock as determined by dividing $15,000 by the fair market value of a share of Common Stock on the date of the annual meeting in question. Any fractional share will be rounded up to the next full share. For purposes of the Plan, fair market value on any date means the average of the highest and lowest selling prices or the closing selling price for shares of Common Stock on The Nasdaq Stock Market on that date.

For example, if the fair market value of a share of Common Stock on the date of the annual meeting in question is $40.00, then the Nonemployee Director would receive 375 shares of Restricted Stock (i.e., $15,000 divided by $40.00, rounded up to the next full share).

The Nonemployee Director will not be required to pay for the Restricted Stock. The Restricted Stock will vest in six months; provided, however, that if prior to such date the participant terminates his or her service on the Board of Directors on account of death or disability, then the Restricted Stock will vest in full on the date of such termination of service.

Options

Under the amended Director Plan, each Nonemployee Director automatically will also receive, on the date of the Annual Meeting and at each subsequent annual meeting on which he or she is a Nonemployee Director, an Option to purchase such number of shares of Common Stock as determined by dividing $140,000 by the fair market value of a share of Common Stock on the date of the annual meeting in question. Any fractional share will be rounded up to the next full share. For purposes of the Plan, fair market value on any date means the average of the highest and lowest selling prices or the closing selling price for a share of Common Stock on The Nasdaq Stock Market on that date.

For example, if the fair market value of a share of Common Stock on the date of the annual meeting in question is $40.00, then the Nonemployee Director would receive an Option to purchase 3,500 shares (i.e., $140,000 divided by $40.00, rounded up to the next full share).

The exercise price of the shares subject to each Option will be 100% of the fair market value of the shares on the date of grant. Each Option will become exercisable in one-third increments six months, 18 months and 30 months from the date of grant of the Option; provided, however, that if prior to such date the participant terminates his or her service on the Board of Directors on account of death or disability, then the Option will become exercisable in full on the date of such termination of service. Each Option will terminate 42 months from the date of grant of the Option.

To date, the Companys four current Nonemployee Directors have received, as a group, Options to purchase a total of 59,298 shares of the Companys Common Stock under the Director Plan.

Payment of Exercise Price

The exercise price of each Option must be paid in full in cash at the time of exercise. Any taxes required to be withheld also must be paid at the time of exercise.

12

Restrictions on Transfer of Shares and Options

Options and shares of unvested Restricted Stock may not be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the applicable laws of descent and distribution. However, if permitted by the Board of Directors (in its discretion), a participant may designate one or more beneficiaries to receive any of such participants benefits under the Director Plan following his or her death.

Tax Aspects

Based on managements understanding of current federal income tax laws, the tax consequences of the award of Restricted Stock and Options under the Director Plan are as follows.

A participant will have taxable ordinary income at the time the Restricted Stock vests in an amount equal to the fair market value of the vesting shares of Common Stock on the date of such vesting, unless the participant timely made a prior election under Section 83(b) of the Internal Revenue Code. If a participant makes a Section 83(b) election, the participant will have taxable ordinary income in an amount equal to the fair market value of shares granted at the time of such grant. Any gain or loss recognized upon any later sale or other disposition of the shares of Common Stock generally will be capital gain or loss.

A participant will not have taxable income at the time of grant of an Option, but generally will have ordinary income upon the exercise of such Option in an amount equal to the excess of the fair market value of the purchased shares of Common Stock on the date of exercise over the exercise price of such shares. Any gain or loss recognized upon any later sale or other disposition of the shares of Common Stock generally will be capital gain or loss.

The Company generally will be entitled to a tax deduction in connection with Restricted Stock and Options granted under the Director Plan in an amount equal to the ordinary income realized by the participant.

New Plan Benefits

The following table sets forth with respect to the fiscal year ended September 30, 2006 the maximum value of benefits to be awarded under the Director Plan, if the amendment proposed herein is approved.

| Name of Individual or Group(1) |

Dollar Value ($) |

Number of Units |

||||

| Glenn W. Novotny |

| | ||||

| William E. Brown |

| | ||||

| Stuart W. Booth |

| | ||||

| Brooks M. Pennington III |

| | ||||

| James V. Heim |

| | ||||

| All executive officers, as a group |

| | ||||

| All associates of directors and executive officers, as a group |

||||||

| All directors who are not executive officers, as a group |

$ | 60,000 | (2) | (3) | ||

| All employees who are not executive officers, as a group |

| | ||||

| (1) | Only directors of the Company who are not employees of the Company or an affiliate of the Company are eligible to receive awards under the Director Plan. |

| (2) | Represents the value of the Restricted Stock award to be received at the Annual Meeting and assumes that the Company has four Nonemployee Directors as of the date of the Annual Meeting. Each Nonemployee Director will also receive an Option to purchase a number of shares of the Companys Common Stock determined by dividing $140,000 by the fair market value of the Common Stock on the date of the Annual Meeting. |

13

| (3) | The number of shares subject to grants of Options and Restricted Stock under the Director Plan is not determinable, because this number depends on the fair market value of a share of Common Stock on the grant date. On the date of the Annual Meeting, each Nonemployee Director will receive an Option to purchase a number of shares equal to $140,000 divided by the fair market value of the Companys Common Stock on the date of the Annual Meeting and a number of shares of Restricted Stock equal to $15,000 divided by such fair market value. |

Required Vote

The affirmative vote of a majority of the shares of Common Stock and Class B Stock, voting together as a class, present in person or by proxy at the Annual Meeting and entitled to vote, is required to approve the proposed amendment to the Director Plan.

The Board of Directors unanimously recommends that stockholders vote FOR the proposal to approve the amendment to the Director Plan.

14

AUDIT COMMITTEE REPORT

ON AUDITED FINANCIAL STATEMENTS

The Audit Committee of the Board consists of the directors whose signatures appear below. Each member of the Audit Committee is independent as defined in the NASD Rules and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the Exchange Act).

The Audit Committees general function is to oversee the Companys accounting and financial reporting processes and the audits of the Companys financial statements, including monitoring the integrity of the Companys financial statements, the independent registered public accounting firms qualifications and independence, and the performance of the Companys independent registered public accounting firm. Its specific responsibilities are set forth in its charter, a copy of which is attached as Appendix A to this proxy statement.

As required by the charter, the Audit Committee reviewed the Companys financial statements for fiscal 2005 and met with management, as well as with representatives of Deloitte & Touche LLP, the Companys independent registered public accounting firm, to discuss the financial statements. The Audit Committee also discussed with representatives of Deloitte & Touche LLP the matters required to be discussed by Statement on Auditing Standards 61, Communication with Audit Committees.

In addition, the Audit Committee discussed with representatives of Deloitte & Touche LLP their independence from management and the Company, including the matters in the written disclosures required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees.

Based on these discussions, the financial statement review and other matters it deemed relevant, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the Companys Annual Report on Form 10-K for the fiscal year ended September 24, 2005.

| December 14, 2005 |

Audit Committee |

|||

| BRUCE A. WESTPHAL, Chairman | ||||

| JOHN B. BALOUSEK |

||||

| DAVID N. CHICHESTER |

||||

15

REPORT OF THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

To the Board of Directors:

As members of the Compensation Committee, it is our duty to determine the compensation for officers and directors and to administer the Companys equity incentive plans. In addition, we evaluate the performance of management and related matters.

As a public company, we use four primary tools to compensate executives. They are base salary, cash bonus, restricted stock and stock options. Together they combine to provide an executives total compensation package. We view base salary as a primary indicator of the market value needed to attract an executive with the skill and expertise to perform the duties and discharge the responsibilities of the position. We periodically retain outside assistance to counsel us in determining market value. We view cash bonus as a means of rewarding short-term performance which exceeds established goals, and we utilize restricted stock and stock options as a means of linking our executives long-term benefits to the rate of return received by our stockholders.

During fiscal 2004 and fiscal 2005, we retained the services of two compensation consulting firms to assist in determining the market value compensation for our Chief Executive Officer, Glenn W. Novotny, and other executive officers. Survey data, coupled with performance based peer group evaluations, were utilized to determine competitive short and long-term awards for Mr. Novotny. Based on the survey and other data and the Companys financial performance, the Compensation Committee increased Mr. Novotnys annual base salary from $661,500 as of October 2004 to $700,000 as of October 2005.

During fiscal 2005 and based on the Companys performance in fiscal 2004, the Compensation Committee determined to pay a bonus of $410,000 in respect of fiscal 2004 to Mr. Novotny. The Compensation Committee also granted options to each of the Companys executive officers, including Mr. Novotny. In addition, in November 2005, the Compensation Committee also granted Mr. Novotny a restricted stock award of 40,000 shares of the Companys Common Stock. In connection with his receipt of this restricted stock award, Mr. Novotny entered into agreements with the Company containing confidentiality and noncompetition provisions.

In determining executive compensation, the Compensation Committee considers, among other factors, the possible tax consequences to the Company and to the executives. However, tax consequences are subject to many factors (such as changes in the tax laws and regulations or interpretations thereof and the timing and nature of various decisions by executives regarding options and other rights) that are beyond the control of either the Compensation Committee or the Company. In addition, the Compensation Committee believes that it is important to retain maximum flexibility in designing compensation programs that meet its stated objectives. For all of the foregoing reasons, the Compensation Committee will not necessarily limit compensation to those levels or types of compensation that will be tax deductible. The Compensation Committee will, of course, consider alternative forms of compensation, consistent with its compensation goals, that preserve deductibility.

We continue to subscribe to the philosophy that the Companys overall performance and its return to stockholders will be the primary areas of consideration when rewarding the Companys top executives. It is our goal to ensure that our executives are paid competitively with the market and are rewarded for performance that benefits the stockholders.

| December 14, 2005 | Compensation Committee | |||

| JOHN B. BALOUSEK, Chairman | ||||

| BRUCE A. WESTPHAL |

||||

| ALFRED A. PIERGALLINI |

||||

16

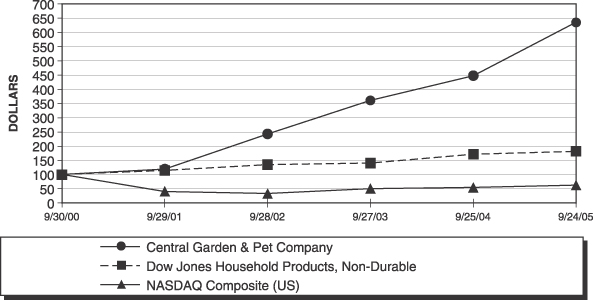

PERFORMANCE GRAPH

The following graph compares the percentage change in the Companys cumulative total stockholder return on its Common Stock for the period from September 30, 2000 to September 24, 2005 with the cumulative total return of the NASDAQ Composite (U.S.) Index and the Dow Jones Non-Durable Household Products Index, a peer group index consisting of approximately 30 manufacturers and distributors of household products.

The comparisons in the graph below are based on historical data and are not indicative of, or intended to forecast, the possible future performance of the Companys Common Stock.

|

9/30/00 |

9/29/01 |

9/28/02 |

9/27/03 |

9/25/04 |

9/24/05 |

|||||||||||||

| Central Garden & Pet Company |

$ | 100.00 | $ | 119.65 | $ | 243.01 | $ | 360.77 | $ | 447.97 | $ | 635.34 | ||||||

| Dow Jones Household Products, Non-Durable |

$ | 100.00 | $ | 114.75 | $ | 135.16 | $ | 140.18 | $ | 171.17 | $ | 181.75 | ||||||

| NASDAQ Composite (US) |

$ | 100.00 | $ | 40.88 | $ | 33.35 | $ | 50.87 | $ | 54.84 | $ | 62.91 | ||||||

17

OWNERSHIP OF MANAGEMENT AND PRINCIPAL STOCKHOLDERS

The following table indicates, as to each director, each named executive officer and each holder known to the Company to be the beneficial owner of more than five percent of any class of the Companys voting stock, the number of shares and percentage of the Companys stock beneficially owned as of December 15, 2005.

|

Shares Beneficially Owned as of December 15, 2005 |

|||||||||||

| Beneficial Owner(1) |

Number of Class B Shares |

Number of Common Shares |

Percent(2) |

Percent of Total Voting Power(3) |

|||||||

| William E. Brown |

1,602,659 | 88,227 | (4) | 8.0 | % | 44.6 | % | ||||

| Brooks M. Pennington III(5) |

| 310,632 | (6) | 1.5 | % | * | |||||

| Glenn W. Novotny |

| 147,148 | (7) | * | * | ||||||

| James V. Heim |

| 15,000 | * | * | |||||||

| Stuart W. Booth |

| 53,000 | (8) | * | * | ||||||

| John B. Balousek |

| 10,359 | (9) | * | * | ||||||

| Bruce A. Westphal |

| 25,534 | (10) | * | * | ||||||

| David N. Chichester |

| 8,638 | (11) | * | * | ||||||

| Alfred A. Piergallini |

| 5,266 | (12) | * | * | ||||||

| All directors and executive officers as a group (ten persons(13)) |

1,602,659 | 683,804 | (14) | 10.7 | % | 46.1 | % | ||||

| (*) | Less than 1%. |

| (1) | Unless otherwise indicated, the address of each beneficial owner listed below is 1340 Treat Blvd., Suite 600, Walnut Creek, California 94597. |

| (2) | Represents the number of shares of Class B Stock and Common Stock beneficially owned by each stockholder as a percentage of the total number of shares of Class B Stock and Common Stock outstanding. |

| (3) | Represents the percentage of the voting power of each stockholder after giving effect to the disparate voting rights between the Class B Stock and Common Stock. The voting powers of the Common Stock and the Class B Stock are identical in all respects, except that the holders of Common Stock are entitled to one vote per share and the holders of Class B Stock are entitled to the lesser of ten votes per share or 49% of the total votes cast. |

| (4) | Includes 25,000 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. |

| (5) | The address of Mr. Pennington is 1280 Atlanta Highway, Madison, Georgia 30650. |

| (6) | Includes 7,500 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005; 49,040 shares held by BPCB Partners, L.P., with respect to which Mr. Pennington has sole voting and dispositive power as the sole member of its general partner; 7,604 shares held by Pennington Management Company II, LLC, in which Mr. Pennington has an ownership interest and of which Mr. Pennington is the president; and 6,938 shares owned by his spouse. Mr. Pennington disclaims beneficial ownership of the shares held by BPCB Partners, L.P. and Pennington Management Company II, LLC, except to the extent of his pecuniary interest therein, and the 6,938 shares held by his spouse. |

| (7) | Includes 25,000 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. |

| (8) | Includes 43,000 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. |

| (9) | Includes 7,286 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. |

18

| (10) | Includes 6,300 shares held by a limited partnership of which Mr. Westphal is general partner and 10,461 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. Mr. Westphal disclaims beneficial ownership of the 6,300 shares held by the limited partnership, except to the extent of his pecuniary interest therein. |

| (11) | Includes 7,286 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. |

| (12) | Includes 2,739 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. |

| (13) | Includes shares beneficially owned by Bradley P. Johnson, who assumed the position of President of the Companys Garden Group in November 2005. |

| (14) | Includes 128,272 shares issuable upon exercise of outstanding options exercisable within 60 days of December 15, 2005. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the Exchange Act) requires the Companys executive officers and directors, and persons who own more than ten percent of a registered class of the Companys equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than ten-percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such forms received by it, or written representations from certain reporting persons that no Forms 5 were required for those persons, the Company believes that, during the period from September 25, 2004 to September 24, 2005 all filing requirements applicable to its executive officers, directors, and greater than ten-percent beneficial owners were complied with, except for late filings made by Brooks M. Pennington III, who filed one late Form 4 on February 17, 2005 to report a sale of the Companys Common Stock on February 14, 2005, and David N. Chichester, who filed one late Form 4 on June 29, 2005 to report an option exercise and same-day sale of Common Stock on May 31, 2005.

19

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP served as the Companys independent registered public accounting firm for the fiscal year ended September 24, 2005 and has been selected to serve as the Companys independent registered public accounting firm for fiscal 2006. Representatives of Deloitte & Touche LLP will be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The following table lists the aggregate fees billed for professional services rendered by Deloitte & Touche LLP for all Audit Fees, Audit-Related Fees, Tax Fees, and All Other Fees for the last two fiscal years.

|

Fiscal Year Ended |

||||||

|

September 25, 2004 |

September 24, 2005 |

|||||

| Audit fees |

$ | 1,693,000 | $ | 3,530,000 | ||

| Audit-related fees |

809,000 | 104,000 | ||||

| Tax fees |

403,000 | 4,000 | ||||

| All other fees |

7,000 | 150,000 | ||||

Audit Fees

The audit fees for the fiscal years ended September 25, 2004 and September 24, 2005, respectively, were for professional services rendered for the audits of the Companys consolidated financial statements, statutory and subsidiary audits, consents, income tax provision procedures, and assistance with review of documents filed with the SEC.

Audit-Related Fees

The audit-related fees as of the fiscal years ended September 25, 2004 and September 24, 2005 were primarily related to consultation and assistance with Sarbanes-Oxley compliance, potential acquisitions, registration statements and employee benefit plan audits.

Tax Fees

Tax fees as of the fiscal years ended September 25, 2004 and September 24, 2005 were for services related to tax compliance, including the preparation of tax returns and claims for refund, tax planning and tax advice, including assistance with and representation in tax audits and appeals, advice related to mergers and acquisitions, tax services for employee benefit plans, and requests for rulings or technical advice from tax authorities.

All Other Fees

All other fees for the years ended September 25, 2004 and September 24, 2005 were primarily for services associated with various legal matters.

Audit Committee Authorization of Audit and Non-Audit Services

The Audit Committee has the sole authority to authorize all audit and non-audit services to be provided by the independent registered public accounting firm engaged to conduct the annual audit of the Companys consolidated financial statements. In addition, the Audit Committee has adopted pre-approval policies and procedures which are detailed as to each particular service and the Audit Committee is informed of each service and such policies and procedures do not include delegation of the Audit Committees responsibilities under the Exchange Act to management. The Audit Committee pre-approved fees for all non-audit services provided by the independent registered public accounting firm in fiscal 2005.

20

CODE OF ETHICS

The Company has adopted a code of ethics that applies to all of its directors, officers and employees, including its principal executive officer, principal financial and accounting officer, controller and certain other senior financial personnel. The Code of Ethics, as amended, was filed as Exhibit 14 to the Companys annual report on Form 10-K for the fiscal year ended September 24, 2005.

OTHER MATTERS

The accompanying proxy card grants the proxy holders discretionary authority, to the extent authorized by Rule 14a-4(c) under the Exchange Act, to vote on any matter raised at the Annual Meeting. As of the date of this proxy statement, there are no other matters which management intends to present or has reason to believe others will present at the meeting. If other matters properly come before the meeting, those who act as proxies will vote in accordance with their judgment.

STOCKHOLDER PROPOSALS

If any stockholder intends to present a proposal for action at the Companys annual meeting in 2007 and wishes to have such proposal set forth in managements proxy statement, such stockholder must forward the proposal to the Company so that it is received on or before August 31, 2006. Proposals should be addressed to the Company at 1340 Treat Blvd., Suite 600, Walnut Creek, CA 94597, Attention: Corporate Secretary.

If a stockholder intends to submit a proposal at the Companys annual meeting in 2007, which proposal is not intended to be included in the Companys proxy statement and form of proxy relating to that meeting, the stockholder should give appropriate notice no later than November 22, 2006. If such a stockholder fails to submit the proposal by such date, the Company will not be required to provide any information about the nature of the proposal in its proxy statement and the proxy holders will be allowed to use their discretionary voting authority if the proposal is raised at the Companys annual meeting in 2007.

MANNER AND COST OF SOLICITATION

The Board of Directors of Central Garden & Pet Company is sending you this proxy statement in connection with its solicitation of proxies for use at the Companys Annual Meeting of Stockholders. Certain directors, officers and employees of the Company may solicit proxies on behalf of the Board of Directors by mail, phone, fax or in person. All expenses in connection with the solicitation of this proxy, including the charges of brokerage houses and other custodians, nominees or fiduciaries for forwarding documents to stockholders, will be paid by the Company.

| Dated: December 29, 2005 | By Order of the Board of Directors |

|||

| Stuart W. Booth, Secretary | ||||

21

APPENDIX A

CENTRAL GARDEN & PET COMPANY

CHARTER FOR THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

September 15, 2004

Purpose

The Audit Committee is appointed by the Board to assist the Board in monitoring (1) the integrity of the Companys financial statements, (2) the Companys financial internal control processes, (3) the independent auditors qualifications and independence, (4) the performance of the Companys independent auditors and internal audit function, and (5) the compliance by the Company with legal and regulatory requirements.

Charter Review

The Audit Committee will review and reassess the adequacy of this charter at least annually. In addition, the Company will publicly file this charter if required by the rules of the Securities and Exchange Commission (the SEC).

Membership

The Audit Committee must be comprised of at least three members of the Board. The members will be elected by and serve at the pleasure of the Board. The members of the Audit Committee may not be officers or employees of the Company. Each member of the Audit Committee must be an independent director, as defined by and to the extent required by the rules of the National Association of Securities Dealers, Inc. and the SEC.

Each member of the Audit Committee must be able to read and understand fundamental financial statements, including the Companys balance sheet, income statement and cash flow statement. In addition, at least one member of the Audit Committee must have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background that results in the individuals financial sophistication, including being or having been a chief financial officer or other senior officer with financial oversight responsibilities.

Meetings

The Audit Committee will meet as often as it determines, but not less frequently than quarterly. The Audit Committee will meet with the Companys independent auditor at least quarterly, including upon the completion of the annual audit to review the independent auditors examination and management report, outside the presence of management. The Audit Committee will meet with the Companys internal auditors as it deems appropriate. The Audit Committee shall make regular reports to the Board.

Responsibilities

The responsibilities of the Audit Committee include the following:

| 1. | Appoint, determine compensation for and oversee the independent auditor; |

| 2. | Review the plan and scope of the audit and related services, and pre-approve all audit and permissible non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditor, subject to the de minimus exception for non-audit services described in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934 (the Exchange Act) that are approved by the Audit Committee prior to the completion of the audit; |

A-1

| 3. | Review and discuss with the Companys management and independent auditor the audit results and interim and annual financial statements prior to publicly filing these reports; |

| 4. | Review any significant deficiencies in the design or operation of internal control over financial reporting or material weaknesses therein and any fraud involving management or other employees who have a significant role in the Companys internal control over financial reporting; as disclosed to the Audit Committee by the Companys Chief Executive Officer and Chief Financial Officer in connection with the certification requirements for the Companys periodic reports on Form 10-K and Form 10-Q; |

| 5. | Discuss with management the Companys major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Companys risk assessment and risk management policies; |

| 6. | Discuss with management and the Companys independent auditor any significant changes to generally accepted accounting principles (GAAP), SEC or other regulatory accounting policies or standards and any off-balance sheet structures that could impact the Companys financial statements; |

| 7. | Review and discuss with management the Companys earnings press releases prior to their release, including any pro forma or adjusted non-GAAP information; |

| 8. | Review and resolve any significant disputes between management and the independent auditor that arise in connection with the preparation of the audited financial statements; |

| 9. | Review and discuss with the independent auditor, management reports describing all critical accounting policies and practices to be used, alternative GAAP methods discussed with management, the ramifications of using such alternative methods and the auditors preferred method, and any other material communications between the auditor and management; |

| 10. | Review major issues regarding accounting principles and practices that could significantly impact the Companys financial statements and discuss with the Companys independent auditor significant accounting policies, management judgments and accounting estimates that affect the financial statements, any difficulties encountered in the course of the audit work, any restrictions on the scope of the auditors activities or access to requested information, and disagreements with management, as required to be discussed by Statement of Accounting Standards No. 61; |

| 11. | Review the required written statement from the Companys independent auditor delineating all relationships between the independent auditor and the Company, and discuss with the independent auditor their independence, including any relationship identified or service provided that may impact the objectivity and independence of the independent auditor; |

| 12. | Evaluate the independence of the independent auditor, including whether the auditors provision of permitted non-audit services is compatible with maintaining the auditors independence; |

| 13. | Confirm whether the independent auditors proposed audit engagement team satisfies applicable auditor rotation rules, including the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law; |

| 14. | Oversee the adequacy of the Companys system of internal control over financial reporting, including obtaining reports from the independent auditor regarding such controls and reviewing any significant findings and recommendations of the independent auditor and managements responses, including any special remedial steps adopted to address material weaknesses in internal control or significant deficiencies; |

| 15. | Review and discuss with the independent auditor the performance of the Companys internal audit function and the quality of the Companys financial accounting personnel; |

| 16. | Establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; |

A-2

| 17. | Review and pre-approve all transactions between the Company and related parties other than compensation transactions; |

| 18. | Discuss with management significant instances of noncompliance with the Companys code of ethics; |

| 19. | Recommend to the Board that the audited financial statements be included in the Companys Form 10-K; |

| 20. | Prepare the Audit Committee report for inclusion in the Companys proxy statement and review required disclosures to determine if they comply with applicable SEC requirements; |

| 21. | Review and assess the results of any governmental or regulatory audits; |

| 22. | Meet with the Companys tax director periodically to assess significant tax risks and exposures; and |

| 23. | Review with the Companys legal counsel any regulatory or legal matters which could have a significant effect on the Companys financial statements. |

In addition to the above responsibilities, the Audit Committee will undertake such other duties as the Board delegates to it or that are required by applicable laws, rules and regulations.

The Audit Committee will have the sole authority to select, determine compensation for, oversee and, where appropriate, replace the Companys independent auditor. The independent auditor will report directly to the Audit Committee, and the Audit Committee will ensure that the independent auditor understands its ultimate accountability to the Audit Committee, as representatives of the Companys stockholders.

The Audit Committee may form and delegate authority to subcommittees consisting of one or more members when appropriate, including the authority to grant pre-approvals of audit and permitted non-audit services, provided that decisions of such subcommittee to grant pre-approvals will be presented to the full Audit Committee at its next scheduled meeting.

The Audit Committee will have the authority, to the extent it deems necessary or appropriate, to retain and determine compensation for independent legal, accounting or other advisors. The Company will provide for appropriate funding, as determined by the Audit Committee, for payment of compensation to the independent auditor for the purpose of rendering or issuing an audit report and to any advisors employed by the Audit Committee.

Reports

The Audit Committee will, to the extent deemed appropriate, record its summaries of recommendations to the Board in written form that will be incorporated as a part of the minutes of the Board. The Audit Committee will also prepare and sign a Report of the Audit Committee for inclusion in the Companys proxy statement for its annual meeting of stockholders.

Limitation of Audit Committees Role

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Companys financial statements and disclosures are complete and accurate and are in accordance with generally accepted accounting principles and applicable rules and regulations. These are the responsibilities of management and the independent auditor.

A-3

APPENDIX B

CENTRAL GARDEN & PET COMPANY

NONEMPLOYEE DIRECTOR EQUITY INCENTIVE PLAN

(As amended effective December 14, 2005)

SECTION 1

ESTABLISHMENT, PURPOSE AND DURATION

1.1 Establishment. Central Garden & Pet Company, a Delaware corporation (the Company), hereby amends the Central Garden & Pet Company Nonemployee Director Equity Incentive Plan (formerly known as the Central Garden & Pet Company Nonemployee Director Stock Option Plan, the Plan), for the benefit of nonemployee members of the Board of Directors of the Company (Nonemployee Directors), in order to compensate such Nonemployee Directors for their services by awarding them stock options (Options) and restricted shares of Company common stock (Restricted Shares) under the Plan.

1.2 Purpose of the Plan. The purpose of the Plan is to promote the success, and enhance the value, of the Company, by attracting, retaining and motivating Nonemployee Directors of outstanding competence. The Plan also is designed to align the interests of Nonemployee Directors with the interests of the stockholders of the Company.