and other factors that the Committee considers important. Company net sales for fiscal

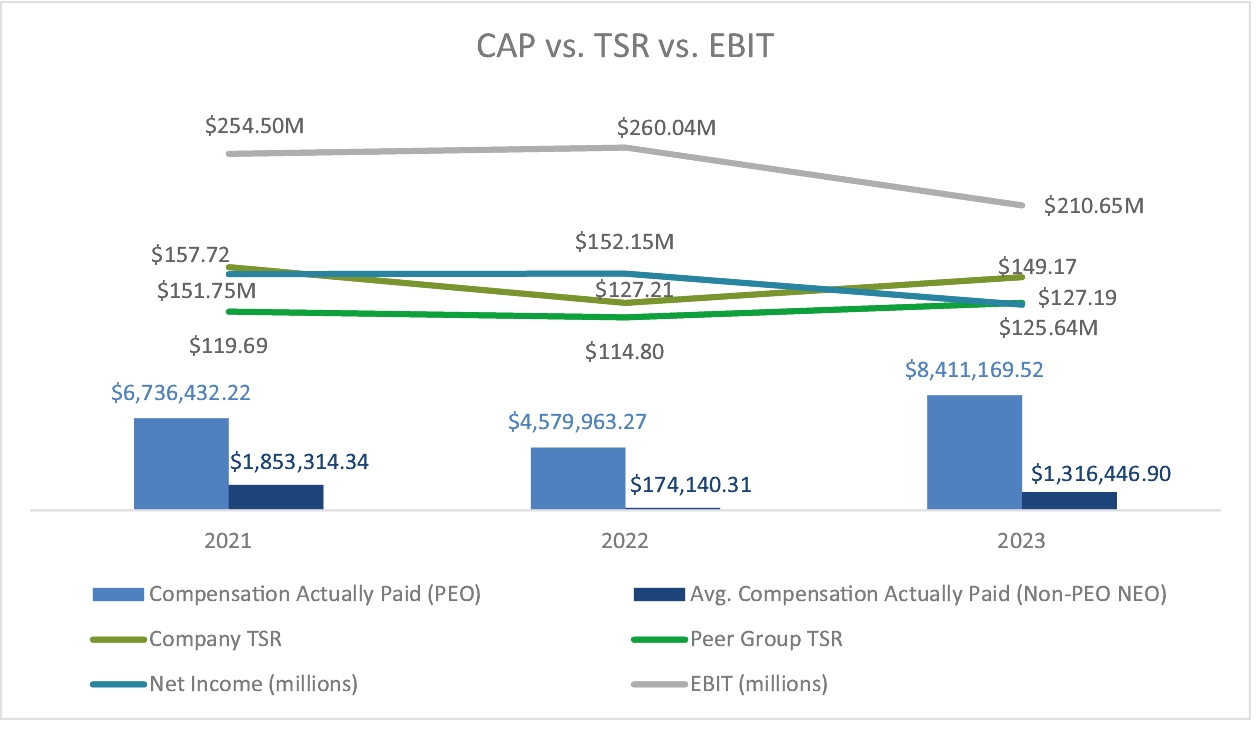

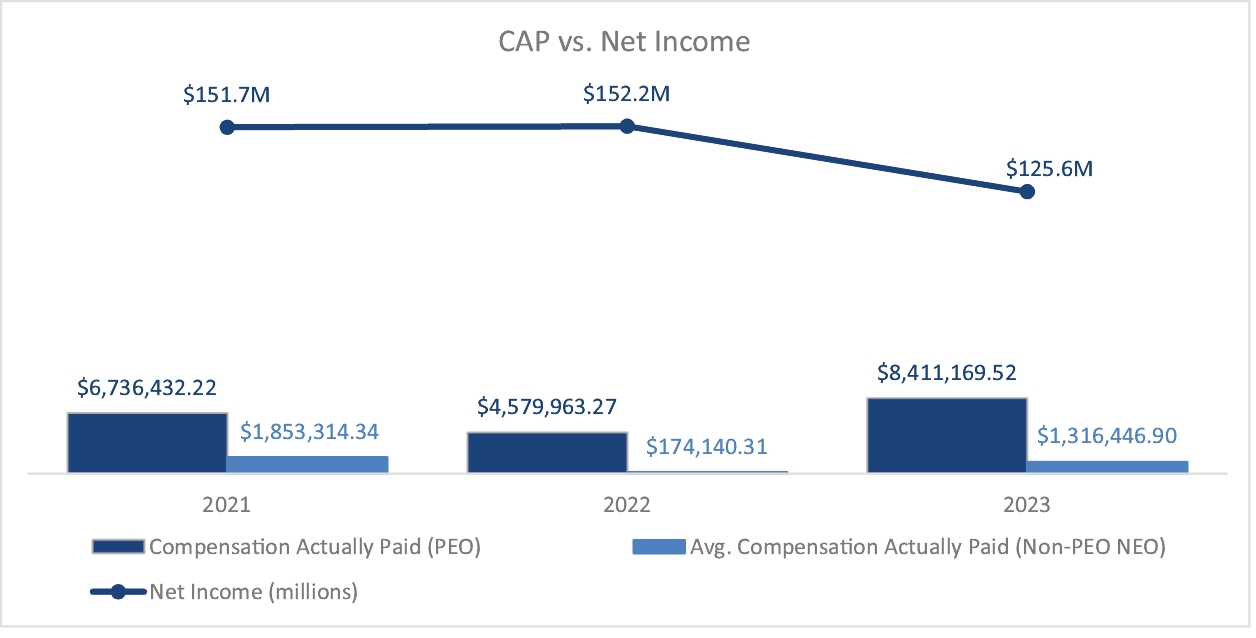

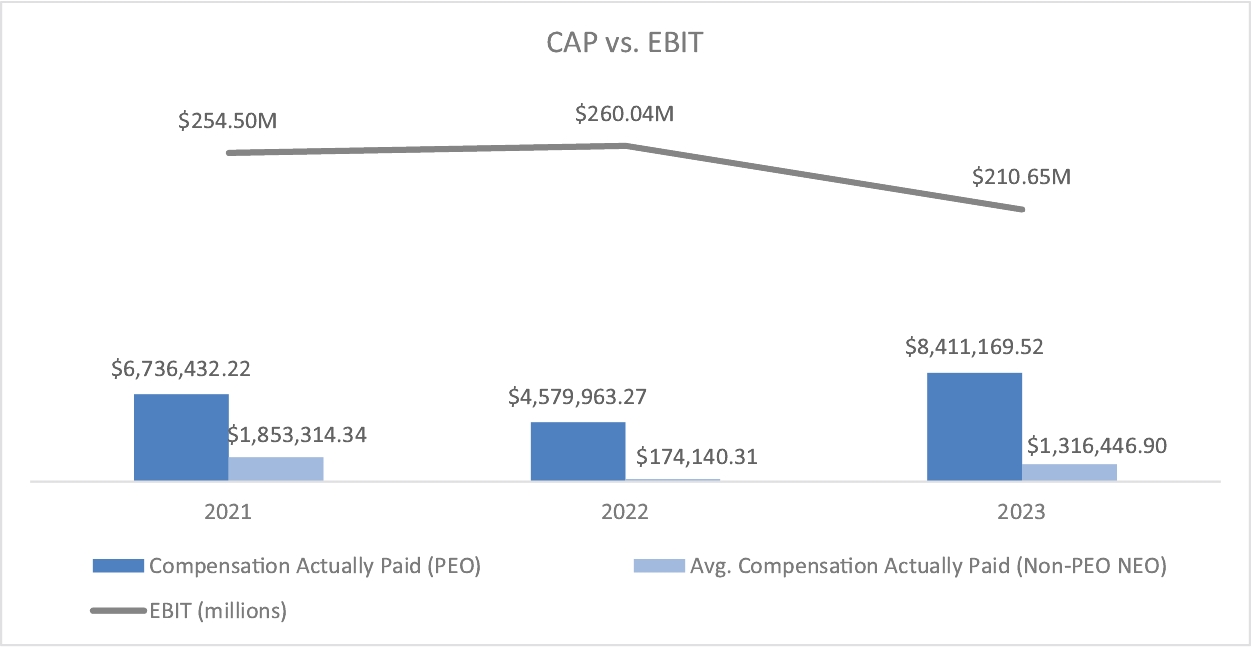

2023 were $3,310.1 million compared to a MIP target of $3,445 million. Company Gross margin in fiscal 2023 was 28.6% on a GAAP basis and 28.9% on a non-GAAP basis, compared with a MIP target of 30.3%, and EBIT for fiscal 2023 was $211.0 million

on a GAAP basis and $227 million on a non-GAAP basis, compared to a MIP target of $261.0 million. Pet Segment net sales for fiscal 2023 were $1,877.2 million compared to a MIP target of $1,917.0 million, and EBIT for fiscal 2023 was

$198.0 million on a GAAP basis and $216.4 million on a non-GAAP basis compared to a MIP target of $212.0 million. Garden Segment net sales for fiscal 2023 were $1,432.9 million compared to a MIP target of $1,528.0 million, and EBIT for fiscal

2023 was $123.5 million on a GAAP basis and $121.6 million on a non-GAAP basis compared to a MIP target of $166.0 million. The Committee has not yet determined the bonus amounts to be paid to the named executive officers with respect to fiscal

2023. The Company will report the fiscal 2023 bonus determinations in a Form 8-K once decisions are made.

Equity Awards

In fiscal 2023, the Committee used a combination of restricted stock

awards and PSUs for equity compensation, as well as a one-time premium-priced option grant for Mr. Cofer, as described below.

Stock Options

In fiscal 2023, the Committee decided to award Mr. Cofer a one-time

premium priced grant of non-qualified stock options, in addition to the equity required by his employment agreement. On February 6, 2023, Mr. Cofer was granted an award of options to purchase 40,000 shares of Class A Stock with an exercise

price of $46.75, vesting in three increments of 33.3% commencing on the fifth anniversary of the February 6, 2023 date of grant and expiring on the tenth anniversary of the date of grant. The decision of the Committee to grant this option award

reflected, among other things, the excellence of Mr. Cofer’s work in developing and advancing the Company’s long-term strategy, the Company’s performance and the interests of the Company and its stockholders in retaining him for the long-term.

The purpose of the one-time premium priced option grant would be to provide additional performance incentive and further align the interests of Mr. Cofer with the interests of the stockholders of the Company. The stock options were forfeited

upon Mr. Cofer’s resignation.

Restricted Stock

In fiscal 2023, the Committee granted a combination of restricted stock

and PSU’s to executive officers. Generally, restricted stock vests, and the restrictions on transfer lapse, in accordance with a schedule determined by the Committee. The Committee has the authority to accelerate the time at which restrictions

lapse, and/or remove restrictions, on previously granted restricted stock.

In February 2023, the Committee granted 28,290 shares of restricted

Class A common stock with a fair value of approximately $1,150,000 to Mr. Cofer in accordance with his employment agreement, which were forfeited upon his resignation. In February 2023, the Committee also granted 3,075 shares of restricted

Class A common stock with a fair value of approximately $125,000 to each of Messrs. Lahanas, Hanson and Walker. Ms. McCarthy received a grant of 2,460 restricted shares with a fair value of $100,000. The restricted shares granted to Messrs.

Cofer, Lahanas, Hanson and Walker and Ms. McCarthy vest over three years.

In February 2023, the executive officers were granted PSUs with respect

to the target number of shares of the Company’s Class A common stock based on their award target divided by the stock price on the grant date. The actual number of PSUs earned may vary from the target number and will be determined at the end of

the four-year performance period based on performance against the applicable performance goals (including pre-defined adjustments thereto) and targets over such performance period. Ultimately, the total number of shares awarded to the executive

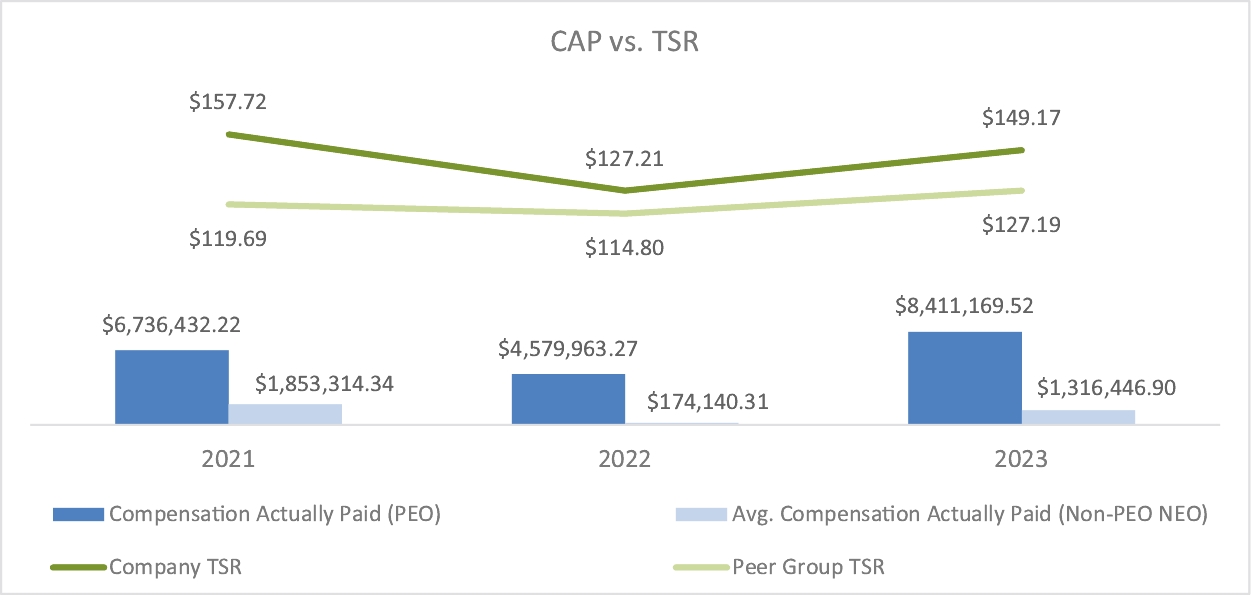

is based on company performance over the performance period, and may range from 65% to 225% of target, including the impact of any increase or decrease by up to 25 percentage points based on a relative total shareholder return (TSR) modifier.

The relative TSR modifier for the PSU awards is based on the following peer group, which includes lawn and garden and pet supplies companies and other consumer products companies: Scotts Miracle-Gro Co., Spectrum Brands Holdings Inc., J.M.

Smucker Co., Church & Dwight Co., Helen of Troy Ltd., Newell Brands Inc., The Clorox Company, Edgewell Personal Care Co., Tupperware Brands Corp., and Energizer Holdings Inc.

The actual number of PSUs earned will be determined using the following

formula based on fiscal 2026 results:

Target Number of FY23 PSUs x (Primary Measures Multiplier +/- TSR Modifier) =

total shares of Company Class A common stock earned under the FY23 PSUs